Understanding financial terms is essential for running a successful business. One of the most important concepts is principal. Whether you’re taking out a business loan or managing cash flow, knowing what principal means can help you make smarter financial decisions. This article explains principal in simple terms and shows how it affects your business finances.

What Does Principal Mean in Finance?

Principal refers to the original amount of money borrowed or invested. When you take out a loan, the principal is the actual sum you receive from the lender. This amount does not include interest, fees, or any other charges.

For example, if you borrow $50,000 for your business, that $50,000 is your principal. Over time, you’ll repay this amount plus interest. The interest is the cost of borrowing money. Therefore, understanding the difference between principal and interest is crucial for managing debt effectively.

Additionally, principal can also refer to the initial investment in a financial account. However, in the context of business loans and cash flow, we focus primarily on borrowed amounts.

How Principal Works in Business Loans

Business loans are a common way to finance growth, purchase equipment, or manage expenses. When you apply for a business loan, the lender approves a specific principal amount based on your creditworthiness and business needs.

Once approved, you receive the principal in your business account. From that point forward, you’re responsible for repaying the principal along with interest according to the loan terms. Most business loans require monthly payments that include both principal and interest portions.

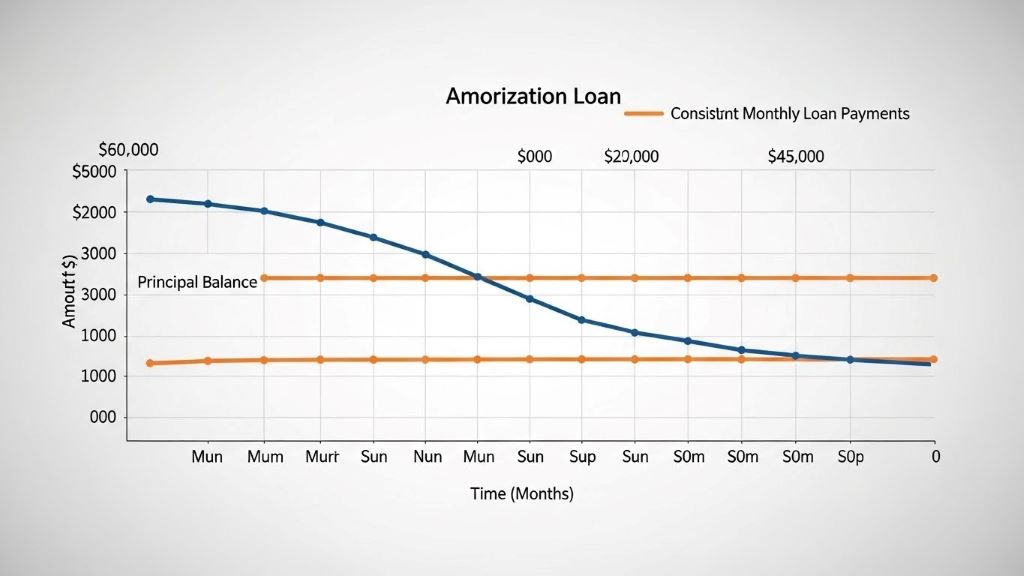

The repayment structure varies depending on the loan type. Some loans use amortization, where each payment covers interest first and then reduces the principal. Others may have interest-only periods followed by principal repayment. Understanding your loan structure helps you plan your cash flow better.

Moreover, the loan term affects how quickly you repay the principal. Shorter terms mean higher monthly payments but less total interest paid. Longer terms reduce monthly payments but increase the total interest cost over time.

Principal vs. Interest: Understanding the Difference

Many business owners confuse principal with interest. However, these are two distinct components of loan repayment. The principal is the borrowed amount, while interest is the fee charged by the lender for providing the loan.

When you make a loan payment, a portion goes toward the principal and a portion goes toward interest. Early in the loan term, interest typically makes up a larger share of each payment. As time passes, more of each payment goes toward reducing the principal balance.

This payment structure is called amortization. It ensures that the loan is fully repaid by the end of the term. Therefore, understanding how your payments are allocated helps you see how quickly you’re reducing your debt.

Additionally, paying extra toward the principal can save you money on interest. Many lenders allow additional principal payments without penalties. This strategy can shorten your loan term and reduce total borrowing costs.

The Impact of Principal on Cash Flow Management

Cash flow is the movement of money in and out of your business. Managing cash flow effectively is vital for survival and growth. Principal repayment directly affects your cash flow because it represents money leaving your business each month.

When you take out a loan, you receive a lump sum (the principal) that boosts your cash flow temporarily. However, you must then make regular payments that reduce your available cash. Therefore, balancing loan benefits with repayment obligations is essential.

Businesses with strong cash flow can handle principal repayments more easily. Conversely, companies with tight cash flow may struggle to meet payment obligations. This is why careful planning before taking on debt is so important.

Furthermore, understanding your repayment schedule helps you forecast future cash flow. You can anticipate when payments are due and ensure you have sufficient funds available. This prevents missed payments, which can damage your credit and result in penalties.

Types of Business Loans and Principal Repayment

Different types of business loans have different principal repayment structures. Understanding these variations helps you choose the right financing for your needs.

Term loans are traditional loans with fixed principal amounts and repayment schedules. You receive the full principal upfront and repay it over a set period with regular payments. These loans are ideal for specific purchases or projects.

Lines of credit work differently. You’re approved for a maximum credit limit, but you only borrow what you need. The principal is the amount you actually draw from the line. You repay this principal plus interest, and then you can borrow again up to your limit.

Equipment financing uses the purchased equipment as collateral. The principal equals the equipment cost, and you repay it over time. If you default, the lender can seize the equipment.

SBA loans, backed by the Small Business Administration, offer favorable terms for qualifying businesses. According to the U.S. Small Business Administration, these loans can have longer repayment periods and lower down payments, which affects how principal is structured and repaid.

Invoice financing advances you money based on outstanding invoices. The principal is the advance amount, which you repay when customers pay their invoices. This type of financing helps manage cash flow gaps.

Calculating Your Principal Balance

Your principal balance is the remaining amount you owe on a loan at any given time. This balance decreases with each payment you make toward the principal. Tracking your principal balance helps you understand how much debt remains.

Most lenders provide monthly statements showing your current principal balance. You can also calculate it yourself by subtracting all principal payments made from the original loan amount. However, be careful not to confuse the total payment amount with the principal portion.

Many online calculators can help you determine your principal balance over time. These tools show you how each payment affects your remaining debt. Therefore, using these resources can improve your financial planning.

Additionally, knowing your principal balance is important for refinancing decisions. If your balance is low, refinancing may not make sense. Conversely, a high balance might benefit from refinancing if you can secure better terms.

Strategies for Managing Principal Repayment

Effective principal management improves your business’s financial health. Several strategies can help you handle principal repayment more efficiently.

First, create a detailed repayment schedule. Mark all payment due dates on your calendar and set up automatic payments if possible. This prevents late fees and protects your credit score.

Second, prioritize high-interest debt. If you have multiple loans, focus extra payments on those with the highest interest rates. This reduces your total interest costs over time while still meeting all minimum principal payments.

Third, consider making extra principal payments when cash flow allows. Even small additional payments can significantly reduce your loan term and interest costs. However, verify that your lender doesn’t charge prepayment penalties.

Fourth, negotiate with lenders if you face financial difficulties. Many lenders offer temporary relief options that can help you manage principal payments during tough times. Communication is key to maintaining good lender relationships.

Finally, monitor your debt-to-income ratio. This metric compares your debt obligations to your business income. Keeping this ratio reasonable ensures that principal repayments don’t overwhelm your cash flow.

How Principal Affects Your Business Credit

Your handling of principal repayment directly impacts your business credit score. Making timely principal payments demonstrates financial responsibility to credit bureaus and future lenders.

Late or missed principal payments damage your credit score. This makes it harder to secure future financing and may result in higher interest rates when you do qualify. Therefore, prioritizing principal repayment protects your borrowing ability.

Additionally, reducing your principal balance improves your credit utilization ratio. This ratio compares your outstanding debt to your available credit. Lower utilization generally means better credit scores.

Lenders review your payment history when considering new loan applications. A strong track record of principal repayment increases your chances of approval. It also helps you negotiate better loan terms and lower interest rates.

Furthermore, maintaining good credit through responsible principal management opens doors to various financing options. You’ll have access to better loan products as your creditworthiness improves.

Principal Payoff and Loan Maturity

Loan maturity is the date when the principal must be fully repaid. At maturity, you’ve satisfied your loan obligation and no longer owe the lender anything. Understanding maturity dates helps you plan long-term finances.

Some loans require a balloon payment at maturity. This means you make smaller payments throughout the loan term, then pay off the remaining principal in one large payment at the end. Balloon payments require careful cash flow planning to ensure you have sufficient funds when due.

Other loans use full amortization, where regular payments gradually reduce the principal to zero by maturity. These loans are more predictable because you know exactly what you’ll pay each month.

According to Investopedia, understanding loan structures and maturity dates is essential for effective financial planning. Early payoff can save money on interest, but some lenders charge fees for this privilege.

Planning for loan maturity involves setting aside funds or arranging refinancing well in advance. This prevents last-minute financial stress and ensures smooth loan completion.

Conclusion

Principal is the foundation of business loans and a critical factor in cash flow management. It represents the actual amount you borrow and must repay over time. Understanding how principal works helps you make informed borrowing decisions and manage debt effectively.

The relationship between principal, interest, and monthly payments determines your total borrowing costs. Additionally, how you handle principal repayment affects your cash flow, credit score, and future financing opportunities. Therefore, developing strategies for managing principal is essential for business success.

Whether you’re considering a new business loan or managing existing debt, focusing on principal repayment creates a stronger financial foundation. By prioritizing timely payments, making extra principal contributions when possible, and choosing the right loan structures, you can use debt strategically to grow your business while maintaining healthy cash flow.

Frequently Asked Questions

What happens if I only pay interest and not principal?

If you only pay interest, your principal balance remains unchanged. You’ll continue owing the full original amount, which must eventually be repaid. Interest-only periods are sometimes part of loan agreements, but principal repayment always comes due eventually.

Can I pay off my principal early without penalty?

Many loans allow early principal repayment without penalties, but not all do. Check your loan agreement for prepayment penalty clauses. If no penalties apply, paying principal early saves you money on interest charges.

How does refinancing affect my principal?

Refinancing replaces your current loan with a new one. The new loan’s principal typically equals your remaining balance on the old loan. However, you might refinance for a larger amount and receive the difference as cash, increasing your principal.

Is principal tax deductible for business loans?

No, principal repayment is not tax deductible. However, the interest portion of your loan payments typically is deductible as a business expense. Consult with a tax professional for guidance specific to your situation.

What’s the difference between principal and principal balance?

Principal refers to the original loan amount you borrowed. Principal balance is the amount you currently owe, which decreases as you make payments. Your principal balance starts equal to the principal and declines over time.

Related Topics:

Promotional Leaflet Essentials: What Makes People Actually Read (Not Bin) Your Marketing